There are situations that could arise in which additional time is needed to be able to file your tax return. The U.S citizens and resident aliens abroad can file the IRS Form 2350 to request for an extension of time to file their tax return by the due date of filing their return only if they expect to file Form 2555 or 2555-EZ.

Your Best Solution to Fill out IRS Form 2350

You can utilize the superb capabilities of Wondershare PDFelement - Редактор PDF-файлов to fill out your IRS Form 2350 easily. It boasts of a form filling feature that can fill out any type of PDF form comfortably with errors.

![]() Работает на основе ИИ

Работает на основе ИИ

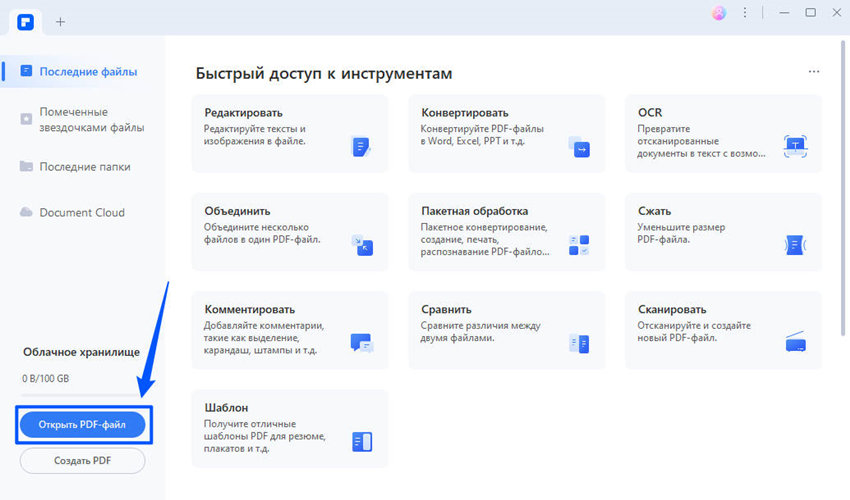

This program is an all in one PDF solution which can help you solve all your PDF needs in just a few clicks and the good thing is that it is affordable. Apart from filling PDF forms, other exciting features include supporting digital signature that makes your official documents legal and authentic, splitting, merging and creating new PDF documents and a whole lot more.

It is also supported by Mac and Windows operating system. The most important thing in filling out your PDF forms using PDFelement is to open it on the platform and once this is done, the program will assist you in filling it out comfortably.

Instructions for How to Complete IRS Form 2350

What will you do if you are required to fill out an IRS Form 2350? It is simple. Just open it on PDFelement and fill it out using the program. The following step by step guide will help accomplishing this task.

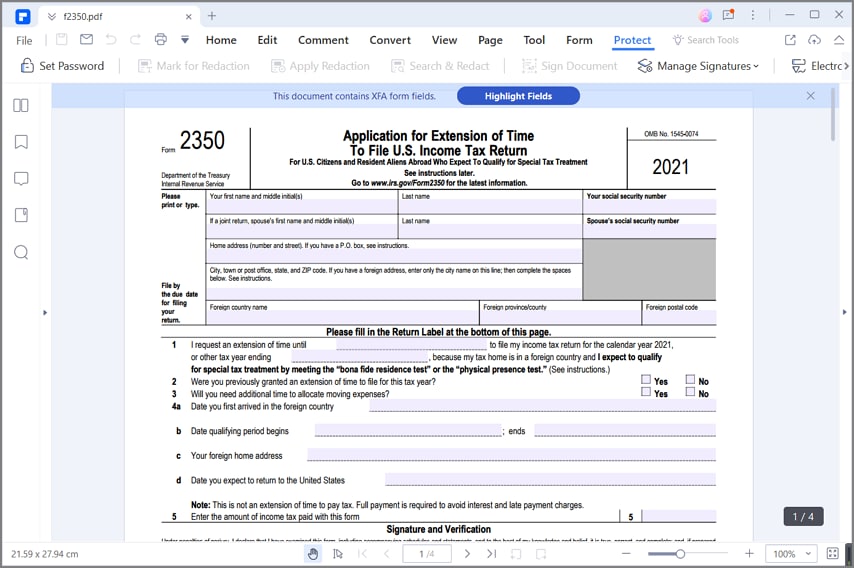

Step 1: Go to the official government website and download the form. Open it on PDFelement and start filling it out.

Step 2: At the top of the form, type in your first name, initial, last name and social security number. If you are filing a joint return, then type your spouse first name, initial and last name. Also enter your spouse social security number. Then write your home address. It should include number and street, city, town, state and zip code. If you have a foreign address, then enter the foreign country name, foreign province and foreign postal code.

Step 3: Go to line 1. If you plan to qualify for the bona fide resident test, enter the date that is 1 year and 30 days from the first day of your next full term year. However, if you plan to qualify under the physical presence test, enter a date that is 12 months and 30 days from your first full day in a foreign country.

![]() Работает на основе ИИ

Работает на основе ИИ

Step 4: Answer yes or no on line 2 if you have been previously granted an extension of time to file for tax this year. You answer by checking any of the appropriate boxes.

Step 5: Line 3 asks if you will need additional time to allocate moving expenses. To answer this question, check any of the yes or no boxes. For example, if yes, check the yes box and if not required, check the no box

Step 6: On line 4a, you are required to enter the day, month and year of your arrival in a foreign country. Enter the qualifying period beginning and ending date on line 4b. Note that your beginning date of the qualifying period is the first full day in a foreign country which is usually the day after the arrival date recorded on line 4a while the ending date is the is the date you qualify for special tax treatment by meeting the bona fide residence or physical presence test. On line 4c, enter the physical address where you are living currently in a foreign country and enter the date you plan to return to the United States on line 4d. However, note that if you do not have a specific date in mind, you are expected to leave it blank.

Step 7: You are expected to enter the amount of income tax paid with this form on line 5.

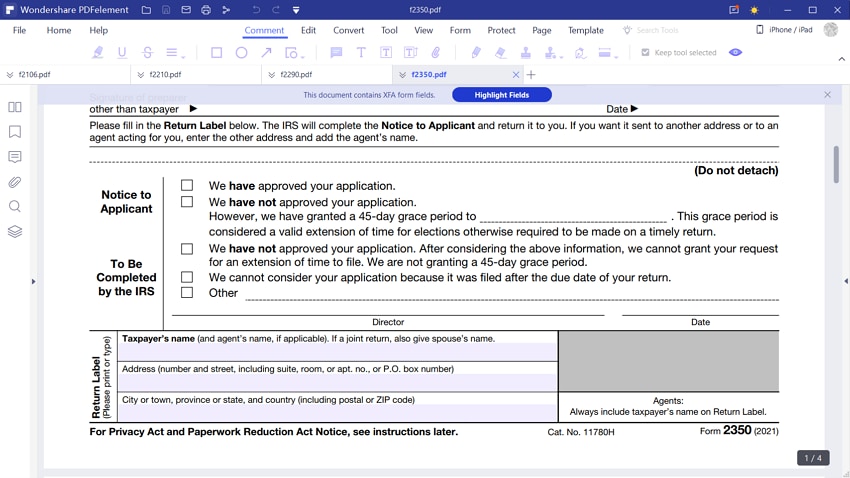

Step 8: Go to the signature and verification part. Note that the taxpayer requesting this extension must sign this form. However, if in cases where you cannot sign for a clear acceptable reason, then any person close to you is expected to sign the form on your behalf. However, there must be a statement attached to the form explaining where you cannot sign the form and the nature of the relationship of the person who is signing on your behalf. Where a joint return is filed with your spouse, then both of you are requested to sign and if one of you cannot sign due to some reasons then attach a statement explaining the reason while your spouse cannot sign the form. The line provided for the preparer should be signed by any individual other than the taxpayer.

Step 9: Complete the return label by writing your name and your spouse name if joint and your full address.

Tips and Warnings for IRS Form 2350

- When filing the IRS form 2350, ensure you mail it to the correct address. You can check the official website to find out the IRS office where it should be filed. Note that filing it to addresses other than the specific address will cause processing delays.

- Note that if you are given an extension, it will be generally a date that is 30 days after the date in which you are expecting to meet the either the physical presence test or the bona fide residence test.

- You can make electronic payments or pay by check or money order with form 2350.